The Augusta Precious Metals lawsuit has captured attention for its implications in the financial and investment world. As a company known for helping individuals invest in precious metals, this lawsuit raises questions about their practices, ethics, and impact on customers. Let’s explore the details step by step.

What Is a Lawsuit?

A lawsuit is a legal action where one party takes another to court to resolve a dispute. In most cases, lawsuits arise when someone feels wronged or when a contract or agreement is breached. These legal battles aim to ensure justice and protect the interests of all parties involved.

In the business world, lawsuits often involve disagreements over services, products, or financial transactions. For companies like Augusta Precious Metals, lawsuits can be especially challenging because they impact their reputation and trust with customers.

Who Is Augusta Precious Metals?

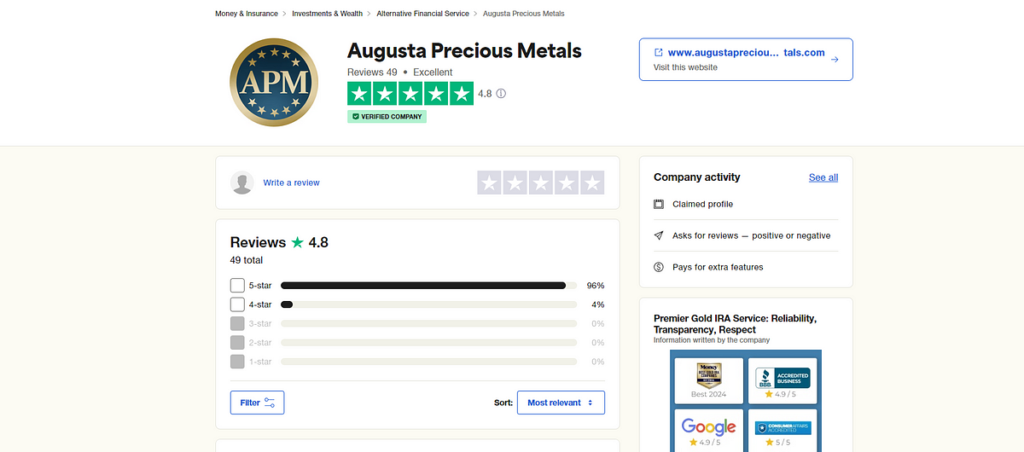

Augusta Precious Metals is a well-known company based in the United States that helps individuals invest in gold and silver. Their services cater to retirees and those seeking to diversify their financial portfolios with precious metals. They guide customers through the process of setting up Gold IRAs (Individual Retirement Accounts) and purchasing gold or silver coins.

The company markets itself as a trustworthy partner for those looking to protect their wealth against economic uncertainties. Augusta Precious Metals emphasizes transparency, education, and customer service in its operations. However, even with a solid reputation, no business is immune to legal challenges.

Why Is There a Lawsuit Involving Augusta Precious Metals?

Legal issues can arise in any industry, and Augusta Precious Metals is no exception. The lawsuit involving Augusta Precious Metals centers around concerns over their business practices and whether customers were misled during their investment journey.

What Are the Allegations?

The allegations in this lawsuit include claims of misleading advertising, unclear communication about fees, and failure to meet customer expectations. Some customers allege that they were not fully informed about the risks associated with precious metal investments. Others point to potential discrepancies in pricing and value.

How Is Augusta Precious Metals Responding?

Augusta Precious Metals has taken the allegations seriously and maintained their commitment to transparency. The company has clarified its policies and reinforced its dedication to educating customers about their investment options. They have also cooperated with legal authorities to address any concerns.

What Does This Mean for Customers?

For customers, lawsuits can create confusion and concern. It’s natural to worry about the safety of investments and the credibility of the company. However, it’s important to focus on verified information and consider Augusta Precious Metals’ actions to resolve the situation. Transparency and open communication are key factors in rebuilding trust.

How Do Lawsuits Affect Companies?

Lawsuits can have a profound impact on companies. They often lead to reputational damage, loss of customer trust, and financial penalties. In some cases, businesses may face stricter regulations or changes to their operating procedures.

For Augusta Precious Metals, the lawsuit may challenge their reputation as a trusted provider of gold and silver investments. However, how they handle the situation will determine their long-term credibility. Companies that respond proactively and take responsibility often emerge stronger.

Staying Informed as a Customer

As a customer, it’s essential to stay informed about the companies you trust with your investments. Research their history, read reviews, and stay updated on any legal challenges they face. Knowledge empowers you to make informed decisions and protect your financial future.

For Augusta Precious Metals customers, understanding the details of the lawsuit and the company’s response can provide clarity. If you’re already invested, reach out to the company for updates and ensure that your concerns are addressed.

What Was the Lawsuit About?

The lawsuit against Augusta Precious Metals focused on claims that customers were not fully informed about the risks and costs of investing in precious metals. Some customers alleged that the company’s advertising painted an overly optimistic picture of returns without highlighting potential downsides.

How Did Augusta Precious Metals Respond?

In response to the lawsuit, Augusta Precious Metals emphasized their commitment to transparency. The company reviewed its practices and made changes to ensure that customers receive complete information. They also introduced additional educational resources to help investors understand the complexities of precious metal investments.

What Happened in the End?

The outcome of the lawsuit highlighted the importance of clear communication between companies and their customers. Augusta Precious Metals resolved the legal dispute by addressing the allegations and implementing measures to prevent similar issues in the future.

What Can We Learn from This?

The lawsuit serves as a reminder for both companies and customers to prioritize transparency and education. Businesses must provide accurate information and uphold ethical practices, while customers should conduct thorough research before making investment decisions.

What Was the Lawsuit About?

The Augusta Precious Metals lawsuit revolved around claims of misleading advertising and insufficient disclosure of risks and fees. It highlighted the importance of clear and honest communication in the financial industry, especially when dealing with complex investments like gold and silver.

The Bottom Line

The Augusta Precious Metals lawsuit underscores the challenges companies face in maintaining trust and credibility. While lawsuits can be damaging, they also provide an opportunity for growth and improvement. For customers, the key takeaway is to stay informed, ask questions, and choose partners who value transparency and ethics.

In the end, the lawsuit has not only shaped Augusta Precious Metals’ practices but also served as a lesson for the entire industry. It’s a call for everyone involved in investments to prioritize clarity, honesty, and mutual trust.